Watching Grass Grow

I often feel like swing trading is like watching grass grow. It slowly comes into form. Part of this is that because of my risk management strategy. I very slowly commit my money to trades. When starting, if I get a signal for a long entry, then I commit a very small percentage of my trading capital in the effort to stay diversified. In order to answer "why do we do this", I present the following four images:

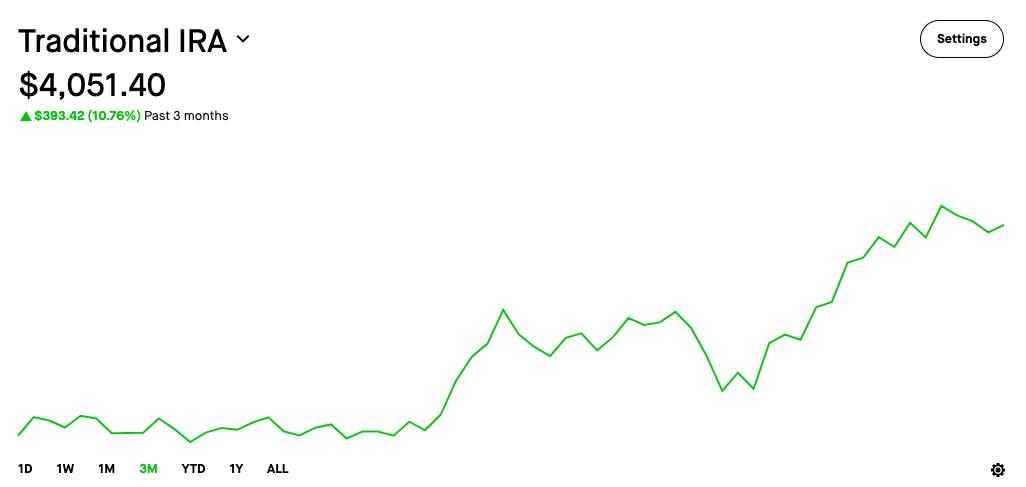

- Here is the actual 3 month return in my demo IRA:

- Here is the 3 month return if you invested in the Nasdaq 100 ETF QQQ:

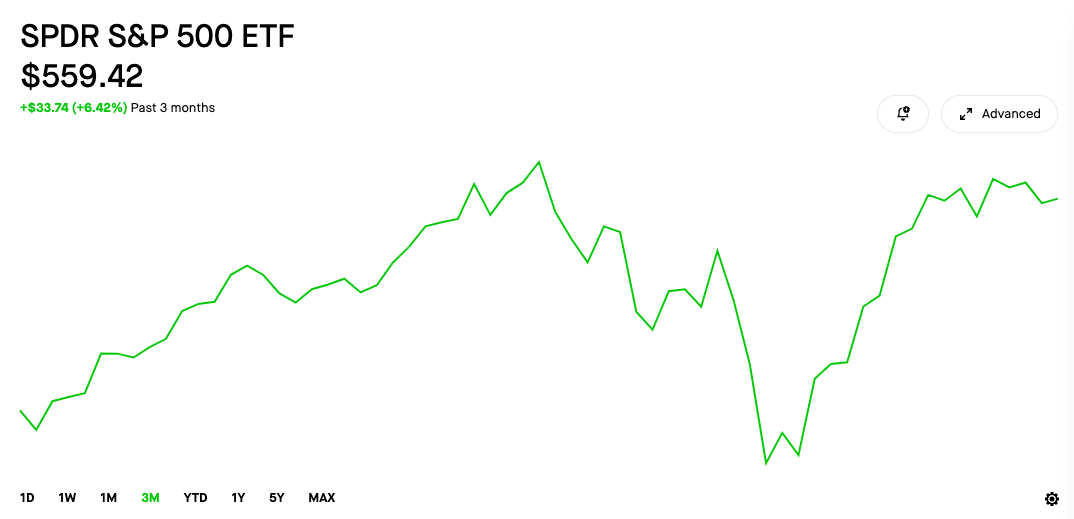

- Here is the 3 month return if you invested in the S&P 500 ETF SPY:

- Here is the 3 month return if you invested in the Down Jones Industrial average DIA:

The question "why not invest in an index fund?" is often asked. As you can see, I can make from 1.4x to 3x more (compounded) using my algorithm. Also consider, I have been slowly committing money to trades as they occur in the last three months and I have only been fully invested since about August 6th, whereas the averages count as fully invested from day one. Also observe that two of the indexes were in a draw down period (excepting DIA), but the demo IRA account was not.

Kind regards,

-- The Management

Member discussion